Unraveling the Intricacies of Value Investing: A Comprehensive Analysis

In today's dynamic investment landscape, understanding various strategies is crucial to optimize your financial portfolio. Value investing, an investment strategy that Warren Buffett famously employs, is often overlooked due to its complex nature. This article aims to demystify value investing and offer a fresh perspective on its practical applications, benefits, and associated risks.

The Genesis of Value Investing

Value investing, rooted in the teachings of Benjamin Graham and David Dodd from Columbia Business School, emphasizes buying stocks at less than their intrinsic value. The idea is to identify undervalued stocks that the market overlooks, offering high potential returns when the market corrects this mispricing. This strategy was popularized in the mid-20th century and has been a preferred investment approach for many legendary investors.

Current Market Trends and Value Investing

As we navigate through the 21st century, the market’s dynamics are changing. More investors are gravitating towards growth stocks, particularly tech stocks, which have shown remarkable performance in recent years. However, this shift doesn’t entirely diminish the relevance of value investing. Economic uncertainties and market corrections often highlight the importance of holding undervalued stocks, providing a safety net during turbulent times.

Impact and Benefits of Value Investing

Value investing’s primary benefit is the potential for significant returns. This strategy often involves comprehensive analysis and patience, waiting for the market to recognize the true value of the undervalued stocks. Furthermore, it provides a margin of safety, as value stocks are less likely to experience drastic drops in price compared to overvalued stocks.

Risks and Real-World Applications of Value Investing

Like any investment strategy, value investing carries its share of risks. The most prominent is the value trap, where a stock appears undervalued but is cheap for a valid reason, such as poor business fundamentals. Real-world applications of value investing require thorough research, financial acumen, and patience to hold onto stocks until their true value is recognized in the market.

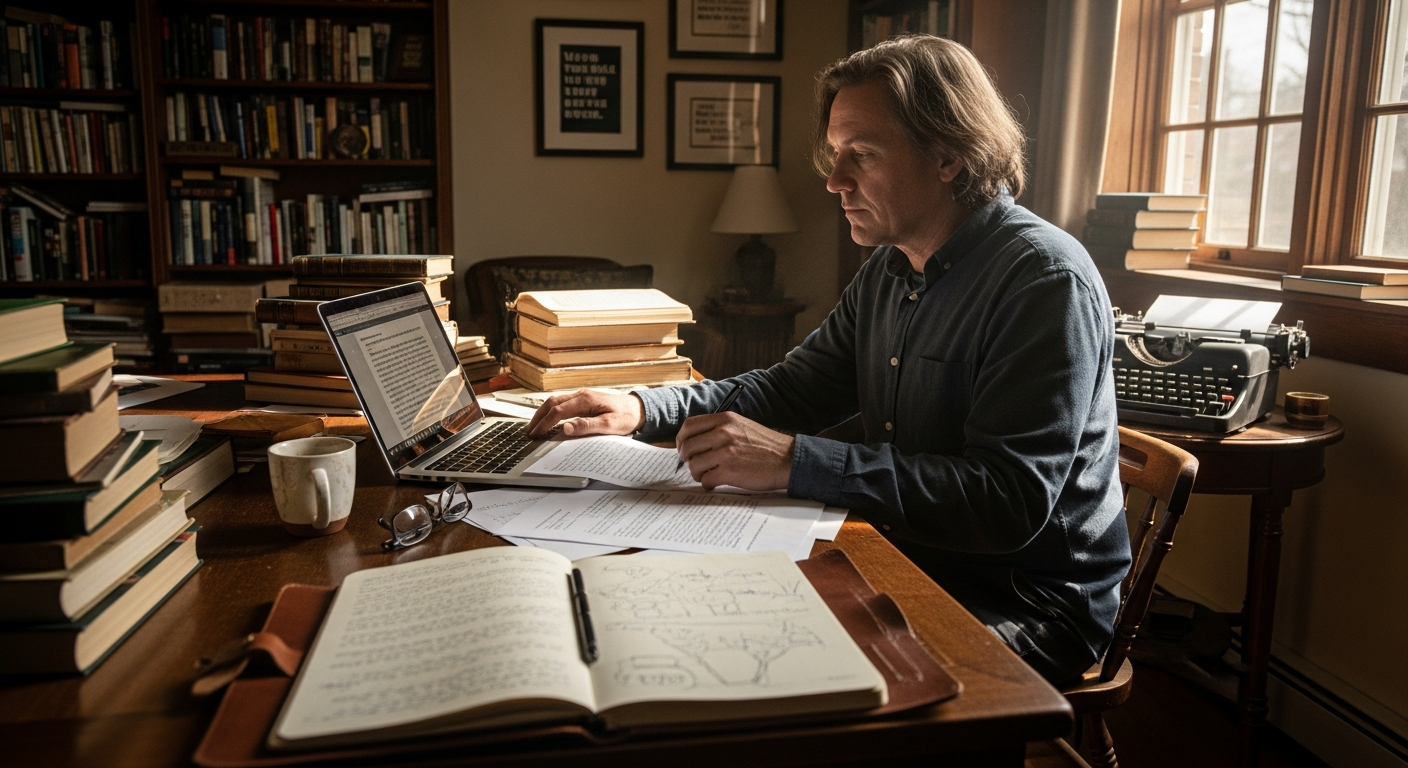

Practical Insights into Value Investing

-

Value investing isn’t for everyone. It requires a long-term perspective and the ability to withstand potential short-term losses.

-

It’s essential to thoroughly research companies before investing. Look beyond the numbers and understand the business model, industry dynamics, and potential growth drivers.

-

Diversification is key. While the focus is on undervalued stocks, maintaining a balanced portfolio can mitigate potential risks.

-

Consulting with a financial advisor or investment professional can provide valuable insights and assist in making informed decisions.

In conclusion, value investing is a viable strategy that can yield significant returns for diligent and patient investors. While it may seem complex, understanding its intricacies can provide an edge in the ever-changing investment landscape. Remember, in the world of investing, knowledge is truly power.